5 Tax Tips for Inheriting NFA Firearms

5 Tax Tips for Inheriting NFA Firearms

Inheriting NFA firearms is complex, but following these 5 essential tax tips can help you avoid legal trouble and ensure compliance with federal and state laws:

- Tax-Free Transfers for Heirs: Use ATF Form 5 for tax-exempt transfers to lawful heirs. Ensure proper documentation like the decedent's death certificate and proof of heir status.

- Register Firearms Immediately: Executors must secure and register inherited NFA firearms promptly. Unregistered firearms cannot be legally transferred and may need to be surrendered.

- Set Up an NFA Gun Trust: A gun trust simplifies inheritance, avoids probate, and reduces transfer costs. Services like TrustNFA help create compliant trusts quickly.

- Check State Laws: State-specific rules may restrict certain firearms or require additional steps like permits, registration, or background checks.

- Seek Professional Help: Missteps can lead to severe penalties, including fines and prison. Experts or services like TrustNFA ensure compliance and simplify the process.

Key takeaway: Proper planning, timely registration, and understanding legal requirements are crucial to inheriting NFA firearms without complications. Start early to avoid penalties and preserve your rights.

What Happens if I Inherit an NFA Firearm?

1. Know the Tax-Free Transfer Rules for Inherited NFA Firearms

Under federal law, NFA firearms can be transferred tax-free to lawful heirs. This exemption spares beneficiaries from paying the usual $200 transfer tax that applies to standard NFA transfers.

To initiate this tax-free process, heirs must use ATF Form 5 (officially known as ATF Form 5320.5). Here's what you need to know about eligibility and the steps involved.

Who Qualifies as a Lawful Heir

The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) defines a lawful heir as someone named in the deceased's will. If no will exists, the heir is determined based on the inheritance laws of the state where the deceased resided. This could include spouses, children, siblings, or other family members, depending on state law and estate documents.

For gun trusts, corporations, or other legal entities to qualify as beneficiaries, they must be explicitly named in the decedent's will or trust documents.

Documentation and Process Overview

To proceed with a tax-exempt transfer, you'll need the following:

- A copy of the decedent's death certificate.

- The will or trust documents proving your status as the lawful heir.

The executor of the estate is responsible for completing ATF Form 5, specifically signing boxes 9 through 11. The executor must also hold onto the NFA firearms securely until the transfer is approved by the ATF, which typically takes 1 to 3 months. If you are both the heir and the executor, you can take possession of the firearms while the Form 5 application is being processed.

Key Restrictions and Requirements

Even with the right documents, there are important restrictions to keep in mind:

- The ATF will deny the transfer if any federal, state, or local law prevents the heir from legally owning or possessing the firearm.

- The transfer must be completed before the probate process is finalized.

- Once the transfer is approved, the firearms must be properly registered in the heir's name.

- A copy of the completed Form 5 must be sent to the Chief Law Enforcement Officer (CLEO) in your area.

It's also worth noting that tax-free transfers only apply to lawful heirs. If you're transferring NFA firearms to someone who doesn’t qualify as an heir, the transfer must go through the standard ATF Form 4 process. This involves paying the $200 transfer tax and is limited to in-state recipients.

2. Complete Proper Registration of Inherited NFA Firearms

Once you've confirmed your status as a lawful heir, the next step is to register any inherited NFA firearms without delay. This is crucial - not just to establish legal ownership, but also to sidestep potential tax issues. Skipping this step isn't just an oversight; it's a serious federal offense that can lead to the firearms being seized and forfeited.

"Possession of an NFA firearm not registered to the possessor is a violation of Federal law and the firearm is subject to seizure and forfeiture." - Bureau of Alcohol, Tobacco and Firearms

The Executor's Role in Registration

The executor of the estate has a critical job: safeguarding the NFA firearms and ensuring they are properly registered. This involves confirming the registration status of each firearm and starting the transfer process to the rightful heirs. If there's any doubt about a firearm's registration, it's essential for the executor to contact the NFA Branch directly, providing proof of their appointment to get accurate information. Completing this registration process also lays the groundwork for future tax and legal compliance.

Handling Unregistered NFA Firearms

In some cases, estates may include NFA firearms that aren't registered with the ATF. If this happens, the executor must reach out to the local ATF office to arrange for these firearms to be abandoned.

Registration Timeline and Key Requirements

The ATF gives executors a reasonable window to finalize the transfer process, but it’s best to handle this before the probate process concludes. Using ATF Form 5, the registration process typically takes 1 to 3 months. During this time, the executor must ensure the firearms are securely stored. These firearms cannot be transferred to third parties for safekeeping or consignment until all NFA compliance requirements are met.

Special Considerations for Interstate Transfers

If the inherited NFA firearms are being transferred across state lines, additional steps are required. Beneficiaries must submit fingerprints using FBI Forms FD-258 along with their transfer application. It's worth noting that the ATF will reject applications from heirs who are prohibited from owning firearms under federal, state, or local laws. These measures are essential to ensure the process remains compliant with all regulations.

Alternative Registration Scenarios

Not every inherited firearm transfer qualifies for the tax-exempt process. To avoid delays or legal headaches, it's important to start the registration process early and double-check that all necessary documentation is accurate and complete. This attention to detail can help prevent complications for the estate and its beneficiaries.

3. Set Up an NFA Gun Trust

An NFA gun trust offers a practical way to simplify the inheritance of firearms regulated under the National Firearms Act (NFA). It not only reduces costs but also speeds up the transfer process while ensuring compliance with legal requirements.

Why NFA Gun Trusts Simplify Inheritance

When NFA firearms are held in a trust, transferring ownership to beneficiaries becomes much easier. The trust eliminates the need for extra paperwork and allows beneficiaries to bypass the usual $200 transfer tax imposed by the ATF. This can lead to considerable savings, especially when multiple NFA items are involved.

More Than Just Tax Savings

The benefits of an NFA gun trust extend beyond saving money. These trusts allow for smooth ownership transitions, shared access among designated trustees, and they completely sidestep the probate process. This makes managing and passing down firearms much more straightforward. For a hassle-free setup, professional services can assist in creating and managing the trust.

Simplified Setup with Professional Services

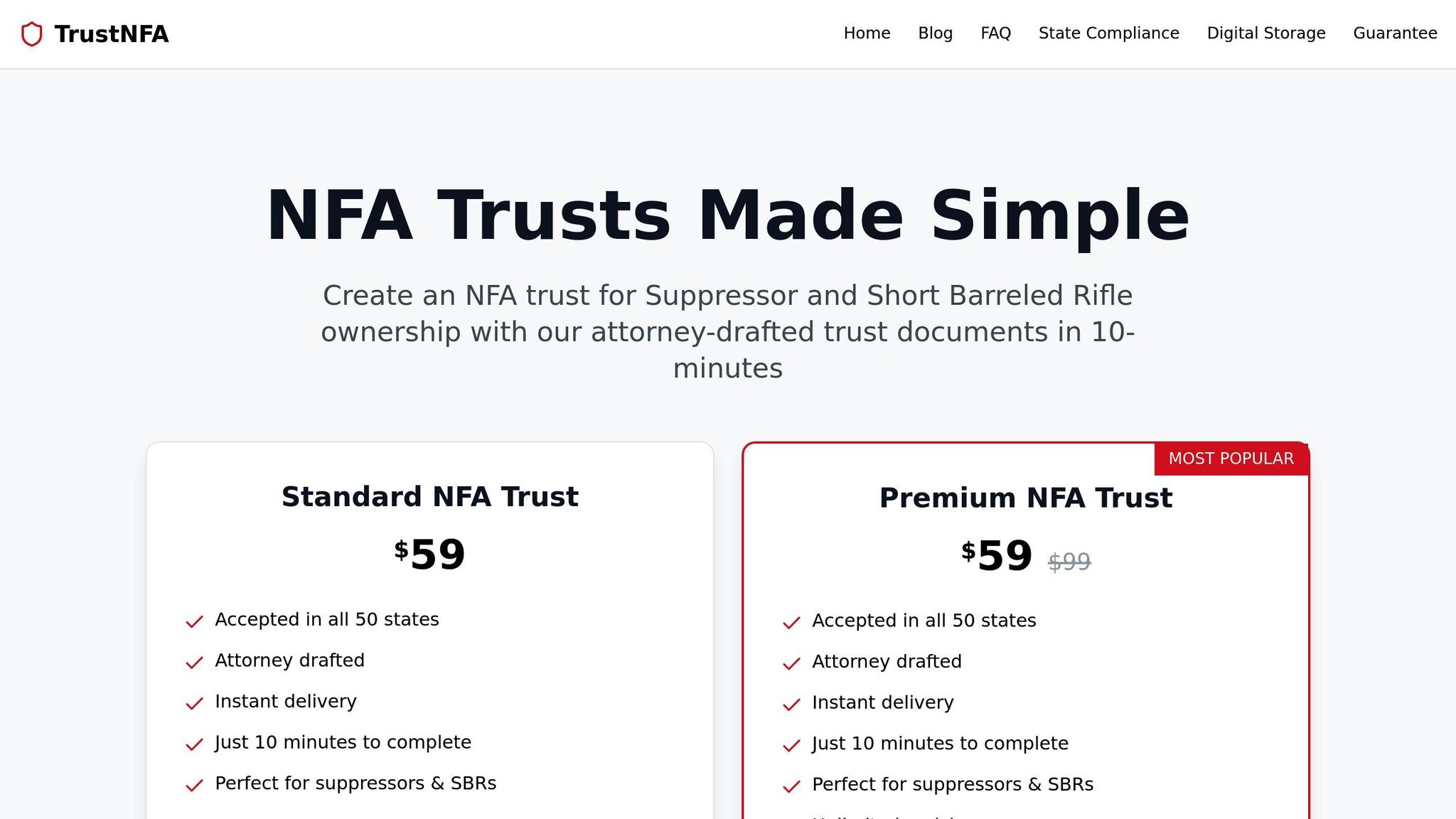

Creating an NFA gun trust doesn’t have to be overwhelming. Services like TrustNFA make the process quick and easy by providing attorney-drafted trust documents that are valid in all 50 states. Their online platform allows you to set up a legally compliant trust in as little as 10 minutes.

TrustNFA offers two options - Standard or Premium - both priced at $59. These packages include lifetime free revisions, secure digital storage, free ATF form generators, and support for unlimited co-trustees and beneficiaries. Plus, there are no recurring fees, and all documents are reviewed by experts to ensure compliance with ATF regulations.

Key Points to Consider When Setting Up Your Trust

When creating an NFA gun trust, it’s essential to name a trustee who is knowledgeable about both state and federal firearm laws. Additionally, keep all original amendments alongside your trust documents to ensure everything stays up-to-date.

Setting up your trust early can help you avoid individual transfer fees and potential complications down the line.

sbb-itb-6d07923

4. Check State-Specific Tax and Compliance Requirements

Federal laws outline the basics of inheriting NFA firearms, but state regulations can significantly influence how the process unfolds. Each state has its own set of rules, which may either streamline or complicate the inheritance process. Understanding your local laws is essential before taking possession of any inherited firearms. Below are some key areas to consider.

State Variations in NFA Regulations

State laws regarding NFA firearms can differ dramatically. Some states have relatively straightforward rules, while others enforce strict regulations that may restrict or even prohibit the inheritance of certain firearms.

Take California, for example. The state prohibits possession of many NFA items, such as suppressors and short-barreled rifles, unless specific exemptions apply. As a result, NFA firearms included in an estate often cannot be legally transferred to heirs within the state. In such cases, a gun trust might be a viable option for facilitating compliant transfers to heirs residing in other states.

Key State Requirements to Research

When inheriting firearms, states may impose various obligations, including:

- Registration Requirements: Some states require inherited firearms to be registered.

- Licenses or Permits: Certain states mandate obtaining a firearms license or permit before taking possession.

- Restrictions on Specific Firearms: Many states limit the types of firearms or magazine capacities that can be legally owned, which could directly affect inherited NFA items.

In states with universal background check laws, you'll also need to pass a background check before taking possession of the firearms. This process becomes more complex if the firearms are coming from another state. Federal law requires these transfers to go through a licensed firearms dealer in your state of residence, which includes completing a background check.

Interstate Inheritance Complications

Inheriting NFA firearms across state lines adds another layer of complexity. You’ll need to comply not only with federal interstate transfer laws but also with your own state’s regulations. Additionally, state laws may influence who qualifies as a lawful heir if there isn’t a will, which could affect whether the transfer qualifies as tax-exempt.

Staying Current with Changing Laws

State laws regarding firearms are subject to frequent changes, so relying on outdated information can lead to serious legal issues. To ensure compliance, consult a local attorney who specializes in firearms law or reach out to your state’s attorney general’s office for the most current guidance. Taking the time to verify the latest regulations can help you avoid costly mistakes and legal trouble. After all, ignorance of the law isn’t an excuse, and mishandling inherited NFA firearms can carry severe consequences.

5. Get Professional Help from Services Like TrustNFA

Dealing with the inheritance of NFA firearms can feel like navigating a legal minefield. The process is layered with complexities, and the consequences of missteps - ranging from criminal charges to forfeiting firearms - are serious. That’s where professional services like TrustNFA come into play, providing expertise to help you manage these challenges with confidence.

Why You Need Professional Assistance

Owning and transferring firearms is no simple matter. Both federal and state laws impose strict regulations. Without proper guidance, it’s easy to unintentionally violate these laws. Estate planning attorney Michael J. Raposa emphasizes the importance of expert help:

"A competent gun trust attorney will be able to help their client navigate the maze of laws related to firearms ownership and the applicability of the gun trust option to a given client's needs."

Services specializing in NFA trusts ensure your trust is not only well-drafted but also fully compliant with legal requirements, making the process of transferring and owning firearms far less daunting.

How TrustNFA Makes It Easy

TrustNFA takes the stress out of setting up an NFA trust. Their attorney-drafted documents are designed specifically for managing suppressors, short-barreled rifles, and other regulated firearms. What could otherwise be a lengthy and confusing process is simplified into a quick, 10-minute setup. TrustNFA’s trusts are valid across all 50 states, and they go a step further by offering lifetime free revisions and secure digital storage. This means your trust stays up-to-date, even as firearm laws change.

More Than Just Documents

Professional services like TrustNFA don’t stop at drafting paperwork. They also provide expert advice to help you maintain accurate firearms inventories and educate executors about their responsibilities. This comprehensive approach not only saves time but also helps you avoid costly legal risks.

Affordable, Reliable Protection

TrustNFA delivers peace of mind at a reasonable cost. Their services reduce the risk of criminal charges, firearm forfeiture, and expensive attorney fees. By using a service like TrustNFA, you can ensure your inheritance planning meets the strict compliance standards required for NFA firearms.

With so much at stake, professional guidance is more than just a convenience - it’s a necessity for safeguarding your legal rights and your inherited firearms.

Conclusion

Inheriting NFA firearms comes with significant legal obligations that go far beyond simply taking ownership of these highly regulated items. The five tax tips discussed here emphasize the importance of understanding the legal requirements necessary to ensure a smooth and compliant inheritance process.

The consequences of failing to comply with NFA regulations are severe. Violations can result in penalties of up to 10 years in prison and fines of $250,000 per firearm [38,40]. Even worse, a conviction under the National Firearms Act can permanently strip you of your right to own or possess firearms.

Timely tax planning and registration are not optional - they are immediate legal necessities. Executors who delay action risk criminal liability for possessing unregistered NFA firearms. Additionally, any unregistered NFA firearms cannot be registered after the original owner’s death, leaving surrendering them to the ATF as the only legal path forward [8,10]. This is why creating an NFA trust can be a game-changer.

An NFA gun trust, one of the strategies highlighted earlier, simplifies the inheritance process. It ensures proper transfers, maintains compliance, and allows for flexible trustee management. However, it’s crucial that the trust is drafted correctly to avoid legal complications down the road. This is where seeking professional assistance becomes critical.

Given the intricate web of federal and state laws, expert guidance is essential. With regulations constantly evolving, relying on services like TrustNFA can provide peace of mind. Their attorney-drafted documents ensure compliance in all 50 states, offering legal security and ongoing support.

Proper planning and professional advice are invaluable in avoiding the harsh penalties of non-compliance. By combining tax-free transfer rules, swift registration, NFA trusts, and expert legal guidance, you can protect your inheritance and your rights.

Don’t wait - take action to ensure compliance, safeguard your assets, and preserve your ability to legally own firearms. By implementing these five tax tips, you can navigate the complexities of NFA firearm inheritance with confidence and security.

FAQs

What happens if you don’t register inherited NFA firearms on time?

Failing to register inherited NFA firearms on time can have serious legal consequences. Federal law strictly prohibits possessing unregistered NFA firearms, with penalties that include fines of up to $250,000 per firearm and up to 10 years in prison. On top of that, unregistered firearms are treated as contraband. This means they can't be legally kept, sold, or transferred - and the ATF has the authority to seize them.

To steer clear of these penalties, the estate's executor must complete and submit ATF Form 5 and wait for approval before transferring the firearms. If the registration process isn't followed, the firearms must be turned over to the ATF, as keeping them would be illegal.

What are the benefits of using an NFA gun trust for inheriting firearms?

An NFA gun trust streamlines the process of inheriting firearms by allowing the trust itself - not an individual - to legally own the firearms. This setup means beneficiaries or co-trustees can take possession without undergoing individual background checks or waiting through the often lengthy ATF approval process. It’s a practical way to make firearm transfers quicker and less complicated.

Another key benefit is the privacy it offers. Since only the trust’s details are filed with the ATF, your personal information stays off public records. For those who value discretion in firearm ownership, this can be a significant advantage. In essence, an NFA trust helps you stay compliant with federal regulations, avoid legal headaches, and save time when managing NFA firearms as part of estate planning.

What should I do if my state has strict laws about inheriting NFA firearms?

If your state enforces strict rules about inheriting NFA firearms, it's crucial to follow the proper steps to stay on the right side of both federal and state laws. Here’s how you can prepare:

- Set up a gun trust. A gun trust can make the transfer process smoother by allowing you to name heirs and detail how the firearms should be passed on. This approach can help minimize legal hurdles while ensuring all laws are followed.

- Include NFA firearms in your will. If you don’t use a trust, be sure your will specifies who will inherit these items. Consult with an experienced attorney to ensure your will is legally valid and covers all necessary details.

When it’s time to transfer ownership, your heirs will need to submit a Form 5 application for each NFA firearm to transfer them without paying the tax. Until the transfer is approved, make sure the firearms are securely stored to avoid any legal issues. These steps can help make the process easier and protect your heirs from potential legal troubles.